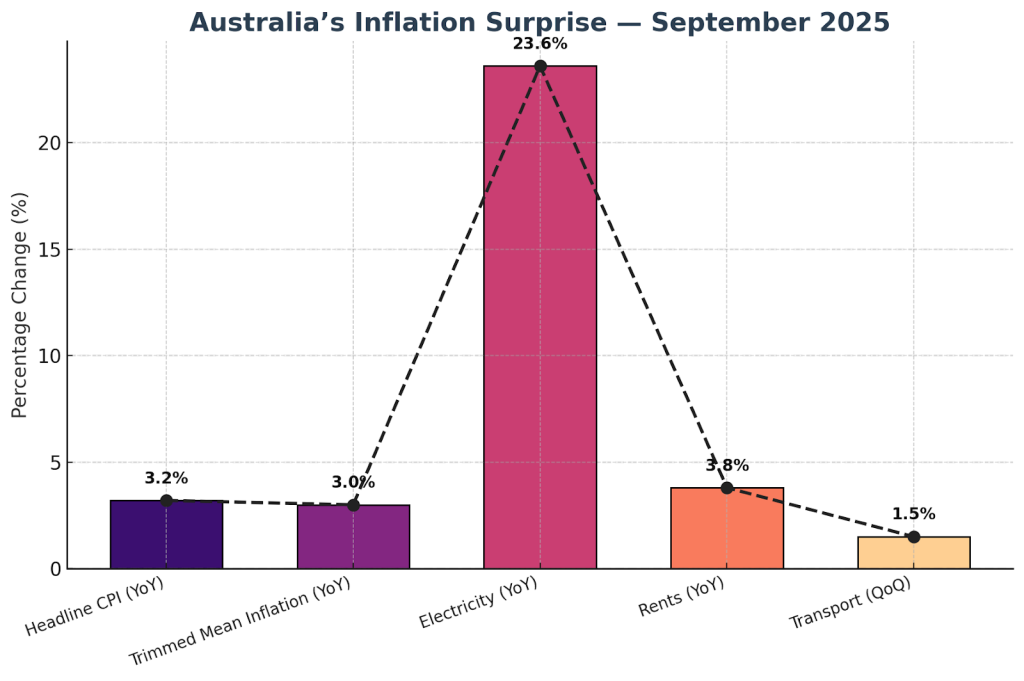

Australia’s inflation unexpectedly jumped in the September quarter. The headline CPI climbed 3.2% year-on-year – the strongest since mid-2024. Even the RBA’s preferred “trimmed mean” measure of core inflation hit 3.0% (its first rise since 2022). Much of the rise came from housing and utilities: for example, electricity prices are now about 23.6% higher than a year ago (largely because last year’s rebates expired). Rents are still rising but at a more moderate 3.8% annual pace. Transport and other living costs also ticked up. In short, price pressures are proving stickier than expected.

Rate Cuts on Hold

With inflation running hot, economists have pushed back their rate-cut forecasts. All the major banks now see the RBA keeping rates on hold at 3.60% through 2025 (and likely into 2026). For example, Commonwealth Bank has scrapped its earlier calls for another cut and expects no further easing “this cycle”. Westpac and ANZ similarly expect the next RBA move only in early 2026, and NAB has moved its forecast out to around mid-2026. A recent Reuters poll shows all economists now agree the cash rate will stay at 3.60% next week and that any final cut may not come until 2026. In practice, this means a longer stretch of stable (or even slightly higher) mortgage rates than many borrowers had hoped.

What Home Buyers and Investors Should Do Now

Given the likely pause in rate cuts, mortgage holders should review their loan strategy. Here are some simple steps to consider:

- Compare fixed vs. variable rates. If you’re on a variable rate, think about fixing part of your loan to lock in today’s rate for a while. If you’re on a fixed loan, check how long it remains on it. You may be able to refinance to a better deal when your fixed term ends. A broker can help model both options.

- Refinance test. With big lenders holding rates steady, competition is heating up. It pays to shop around or get a free home loan health check from a broker. Many borrowers find they can save by switching to a loan with a lower rate or better features. Now is the time, because savings are smaller once RBA cuts arrive.

- Budget with a buffer. Ongoing inflation means bills (energy, rent, groceries) are higher than a year ago. Update your budget and allow for a bit extra in mortgage repayments. We generally recommend building a buffer (for example 1–2% above your current rate) to protect against future rate surprises. Use tools like offset accounts or extra repayments to keep flexibility.

- Plan for scenarios. Run the numbers under two cases: (a) rates stay at 3.60% for months, or (b) one 0.25% cut next year. Compare your repayments in each scenario. This will highlight how much more you can afford, or whether your budget is already tight. A mortgage broker can do this analysis quickly.

Overall, expect steady rates for longer. Affordability pressures (high power bills, housing costs) mean the RBA is in no rush to cut. The flip side is that a stable rate environment lets you plan confidently, review loans now, and lock in good deals before cuts happen.

How Be Smart Finance Can Help

At Be Smart Finance we guide first-home buyers and investors through market changes like these. Our brokers can crunch your numbers, compare home loan options, and structure a strategy that suits you – whether rates stay flat or start easing down the track. Call us on 0408 659 819 or book a free 30-minute consultation today. We’ll help you understand your borrowing power and plan a home loan that works, no matter what the RBA does next.