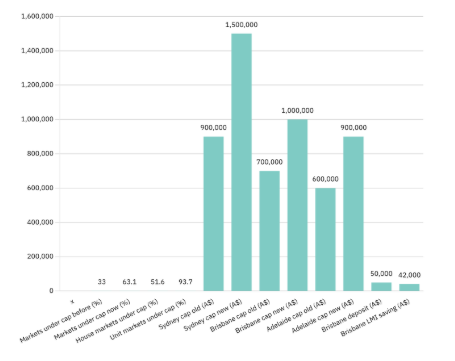

From 1 October 2025, the federal government’s expanded Home Guarantee Scheme makes it easier for Australians to buy their first home with just a 5% deposit. In practice, the changes remove all caps on places and incomes and raise price caps across the country. For first-home buyers (FHB), this means dramatically more suburbs and homes become affordable. Data from housing research shows eligible markets jump from about one-third to 63.1% nationwide, including 51.6% of house markets and 93.7% of unit markets. In dollar terms, Sydney’s price cap soars from $900K to $1.5M (up $600K), Brisbane’s from $700K to $1.0M, and Adelaide’s from $600K to $900K.

These new thresholds better reflect today’s median prices and give buyers in those regions access to far more homes. Importantly, buyers can now enter with a 5% deposit and avoid the lender’s mortgage insurance – the government guarantees the remaining 15% of the loan. In other words, home buyers save many thousands on insurance costs. For example, under the new rules, a Brisbane buyer could purchase a $1.0M home with just a $50K deposit and potentially save around $42K in mortgage insurance.

What’s changing for first-home buyers

Key changes from Oct 1 include:

- Unlimited places: No fixed quota on scheme spots – any eligible first-home buyer with 5% deposit can apply.

- No income caps: Previous income limits (e.g. $125K for singles, $200K for couples) are removed. All buyers now qualify based on home status, not income.

- Higher price caps: Property value limits are lifted in each region. For instance, the NSW capital city/regional centre cap jumps to $1.5 million.

These reforms double the scheme’s reach. Analysts note that with the expanded caps and no location limits, many more suburbs fall under the scheme’s price ceiling. In effect, first-home buyers will no longer be confined to the cheapest outlying suburbs – they can now consider properties in far more of their city and regional markets.

More choice for first-home buyers

The expanded scheme gives FHBs real advantages. By only needing a 5% deposit and skipping LMI, buyers can enter the market years sooner than saving the standard 20%. Government estimates highlight that the policy will “cut years off the time it takes to save for a deposit and save tens of thousands of dollars on lenders’ mortgage insurance”. For example, a buyer in Brisbane could save up to a decade of savings and ~$42K in insurance by using the scheme. In short, 5% deposit means your savings go further toward buying equity rather than covering fees.

What the scheme means for property investors

While the Home Guarantee is aimed at owner-occupiers, the ripple effects matter for investors too. The expanded scheme effectively shifts demand toward more housing markets. In cities like Adelaide, the huge jump in eligible suburbs (up to 46.6% for houses) means more first-time buyers will compete for homes there. Investors should note that rental yields are still solid in many regions (for example, Darwin, Adelaide and Perth historically have strong yields). If demand lifts property values, rents often keep pace. A broker can help investors take advantage by arranging finance on the right terms. We’ll assist with pre-approvals for investment loans (so you can move fast in competitive markets) and offer options like interest-only loans or offset accounts to suit your cash flow. In short, brokers can analyse which suburbs are being “grasped with both hands” by new buyers, and then help investor clients get into position. With supply tight in key markets, having a broker’s guidance on loan structure is valuable for any investor preparing to buy.Ready to get started? At Be Smart Finance, we guide both first-home buyers and investors through these changes. We’ll calculate your new borrowing power, compare home loan options, and ensure you meet the scheme’s criteria. Speak with our brokers today to understand how the expanded Home Guarantee Scheme can work for you. Call us on 0408 659 819 or book a free 30-minute consultation.