The Australian Government has rolled out important updates to the Home Guarantee Scheme (HGS), designed to make the dream of buying a first home more achievable for many young Australians and their families. As housing prices keep rising and budgets feel tighter, the fresh measures are expected to give a lift to thousands who want to get their first toe in the market.

At BeSmart Finance, we see firsthand how government programs can trim the size of the deposit and the cost of a new mortgage. Our mortgage advisors match that support with smart strategies, helping our clients use the new scheme to its fullest as they plan their home-ownership journey.

Key Highlights of the Home Guarantee Scheme

The refreshed scheme now lets singles, couples, and buyers in selected regional areas purchase a home with just a 5% deposit, skipping the expensive lender’s mortgage insurance (LMI). Skipping LMI can save buyers thousands of dollars, making it easier to get over the savings finish line, especially in key markets like Sydney and Melbourne where prices still command record highs.

To buyers who are still working to save that large 20% deposit, the new option is a major game-changer. At BeSmart Finance, our mortgage experts personalize the advice, crafting budgets and timelines that put clients in the best position to secure a loan and jump on the best deals in a fast-moving market.

From October 2025, the Home Guarantee Scheme will offer unlimited places for eligible first-home buyers, removing previous annual caps and making it easier for more Australians to enter the housing market

BeSmart Finance consultants are noticing a surge in enquiries from people keen to grab their first place. By running targeted mortgage strategies, the team speeds up application processing and improves approval odds.

What the Scheme Means for the Market

Population-booming areas in Queensland and Western Australia are expanding quickly, so the new scheme is expected to funnel buyers into those corridors. Analysts warn it won’t wipe out the housing shortage straight away, but it will help first-timers land a home and start building equity sooner.

This is a timely opportunity for families and individuals to purchase a property ahead of expected further price increases. The BeSmart Finance team makes sure clients tap into the scheme while also comparing mortgage rates and features to find a loan perfect for their needs.

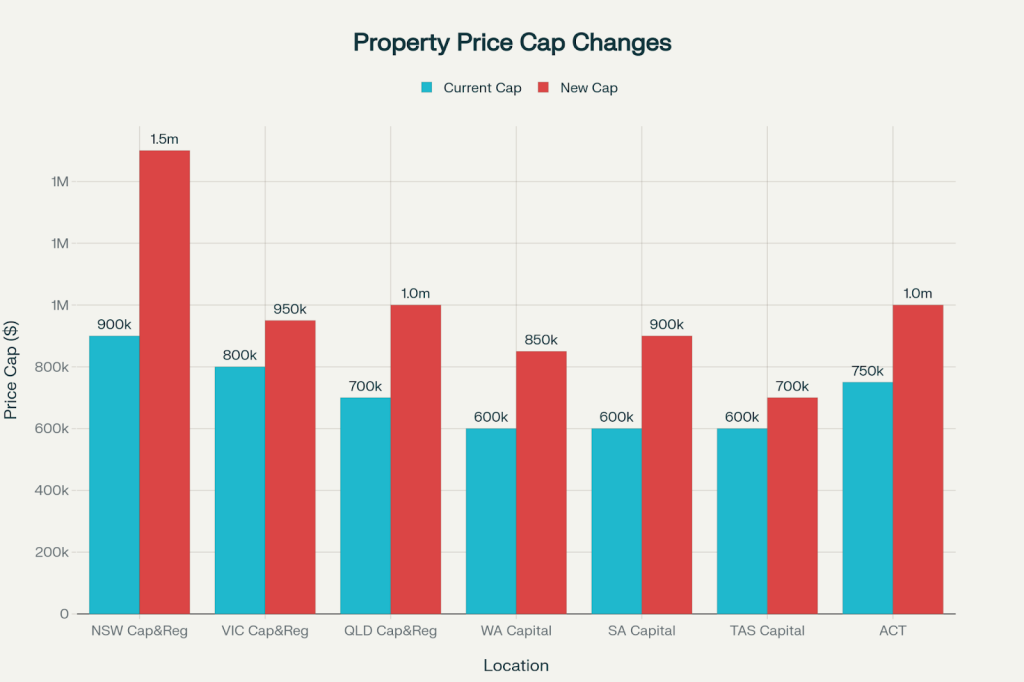

In summary, the Home Guarantee Scheme’s recent broadening constitutes a considered governmental manoeuvre in response to prevailing housing volatility, addressing the unfulfilled pledge to reduce systemic impediments to goal ownership. Its design unrestricted entry, the omission of specific income thresholds, and the elevation of indexed price ceilings advances ownership for a populace previously marginalised. Concomitantly, the initiative provides a catalytic effect for the mortgage sector, inducing heightened transactional throughput while substantiating the broker intermediary as a pivotal counsel in the prudent navigation of newly available instruments

Give us BeSmart Finance, a ring on 408659819 and we’ll walk you through all your loan options or schedule a no-cost consultation so we can show you how to reshape your home or investment loan with real certainty.